Constantemente nos planteamos la duda existencial del porqué muchos prestigiosos gurús y maestros del trading con avalada reputación en el sector de la inversión o especulación financiera «pierden su tiempo» escribiendo libros, artÃculos, blogs, dando charlas o formando a traders cuando podrÃan dedicarse plenamente a la actividad del trading y ganar mucho más dinero.

Constantemente nos planteamos la duda existencial del porqué muchos prestigiosos gurús y maestros del trading con avalada reputación en el sector de la inversión o especulación financiera «pierden su tiempo» escribiendo libros, artÃculos, blogs, dando charlas o formando a traders cuando podrÃan dedicarse plenamente a la actividad del trading y ganar mucho más dinero.

Muchas veces he leÃdo en foros y debates preguntas a los formadores del estilo … «Si sabes tanto sobre bolsa y mercados, sobre los diferentes instrumentos financieros, si conoces tan bien las herramientas de análisis, entonces ¿porqué no especulas e inviertes dinero tú mismo en lugar de dedicarte a instruir a otros traders?»

Obviando por supuesto, a todos los «vendehumos» cuya única pretensión es la de convencer a incautos para que dejen su dinero a cambio de promesas incumplidas, el resto del «mercado de maestros» podrÃa decirse que disfrutan de una legitimidad y de un variado prestigio en relación a su actividad como formadores y adiestradores.

En primer lugar hay que recordar que, aunque el dinero sea la «materia prima» de este oficio o afición, no deberÃa tratarse como una actividad cuyo único objetivo final es hacerse rico. La mayorÃa de los más excelentes traders consiguen ganarse la vida de forma digna y sin más pretensiones. Muy pocos tienen la imperiosa necesidad de disfrutar de los excesos de un lobo de Wall Street y la mayorÃa no están dispuestos a asumir el riesgo o a realizar el sacrificio necesario para conseguirlo.

Asà mismo una actividad no tiene porqué excluir a la otra. De hecho, la mayorÃa de los formadores e instructores de trading dedican parte de su tiempo y capital a invertir y a «tradear» incluso en intradÃa de vez en cuando.

Por no hablar de aquellos gurús y maestros internacionalmente reconocidos que venden miles de libros, ofrecen cursillos carÃsimos a cientos de traders y han conseguido un relevante y envidiable prestigio en la comunidad. Estos expertos ya ganan mucho dinero con estas actividades y a veces lo incrementan invirtiendo en bolsa y a veces lo pierden experimentando con ella.

También debemos recordar que sobre gustos no hay nada escrito y que hay tantas preferencias y pasiones como personas en el mundo. Muchos disfrutan en gran medida desempeñando otras actividades y consideran excesivamente aburrida y absorbente la monótona práctica de pasar mucho tiempo frente a la plataforma de trading entrando y saliendo de los mercados ellos mismos. Los hay con predilección por escribir libros, apasionados en la concepción y programación de robots o indicadores, los hay que se deleitan realizando análisis técnicos, dando charlas, escribiendo artÃculos en blogs y periódicos, relacionándose con otros traders, estudiando los mercados, calculando stops, respondiendo preguntas, investigando, inventando, creando, descubriendo …

También debemos recordar que sobre gustos no hay nada escrito y que hay tantas preferencias y pasiones como personas en el mundo. Muchos disfrutan en gran medida desempeñando otras actividades y consideran excesivamente aburrida y absorbente la monótona práctica de pasar mucho tiempo frente a la plataforma de trading entrando y saliendo de los mercados ellos mismos. Los hay con predilección por escribir libros, apasionados en la concepción y programación de robots o indicadores, los hay que se deleitan realizando análisis técnicos, dando charlas, escribiendo artÃculos en blogs y periódicos, relacionándose con otros traders, estudiando los mercados, calculando stops, respondiendo preguntas, investigando, inventando, creando, descubriendo …

Los programadores informáticos disfrutan realizando proyectos y creando software pero odian tener la obligación de utilizarlo. No le pidas al desarrollador de una base de datos que sea él quien pase las horas metiendo fichas de clientes en su propio programa.

No todos los futbolistas pueden ser delanteros ni buscan alcanzar la fama y el prestigio de un Ronaldo o un Messi. Tampoco la mayorÃa de personas que entran en polÃtica anhelan ser presidentes. Casi la totalidad de los soldados de un ejército no pretenden alcanzar el grado de general. Todas las ocupaciones tienen a sus individuos estrella pero también a sus integrantes corrientes los cuales pueden llegar a ser muy felices con lo que hacen y con lo que tienen.

Muchas modelos muy dotadas para ello no llegan a alcanzar el tÃtulo de «super modelos» simplemente porque eligen no sacrificar una maternidad prematura o no perder calidad en su relación de pareja. Muchos grandes actores y actrices españoles con demostradas capacidades no trabajarán en «Hollywood» porque prefieren permanecer en su paÃs, en su hogar, junto a su familia y amigos.

No me entendáis mal, es evidente que todos quisieran llegar a alcanzar las metas más altas. Tanto en el mundo de la especulación financiera como en cualquier otro, conseguir una total independencia económica y obtener la tranquilidad de no volver a preocuparse por el dinero es un sueño que todos hemos albergado alguna vez.

Pero habitualmente el éxito camina de la mano del sacrificio y dependiendo de la vida que hayamos llevado, de nuestras circunstancias actuales o de la edad y experiencia alcanzada, no todos estamos dispuestos a recorrer o retomar esos senderos.

Y todo esto puede ilustrarse con varias preguntas:

¿Ser ingeniero aeronáutico te habilita como piloto de aviones?

¿Porqué los abogados nunca se representan a sà mismos?

¿Los mecánicos del taller de reparaciones sueñan con correr en la formula-1?

¿Porqué los médicos no tratan sus propias enfermedades?

¿El chef de un restaurante come en casa lo que cocina su mujer?

¿Todos los profesores de gimnasia o dietistas tienen cuerpos perfectos?

¿Ese hombre con un cigarro en la mano, no es el médico que te prohibió fumar?

¿Todos los licenciados en ciencias polÃticas se presentarán a unas elecciones?

¿Para qué estudiar empresariales si no pretendes dirigir una empresa?

y sobre todo … ¿Porqué los buenos economistas no se hacen ricos?

EN CASA DEL HERRERO

EN CASA DEL HERRERO

Dice el refrán «en casa de herrero, cuchillo o cuchara de palo» y no está equivocado.

No siempre quien dirige una pelÃcula forma parte del reparto de actores, al igual que no siempre quien compone una canción será quien se suba al escenario para interpretarla o quien muestre su cara en los discos. No imagino a Miguel de Cervantes lanza en ristre, ataviado con astrosa armadura y sujetando con los dientes las riendas de un desnutrido burro intentando deleitar sobre las tablas de un teatro, tanto a zafios como a cortesanos, tanto a nobles como a ilustres de rancio abolengo.

Todos tenemos nuestro lugar en el mundo, y en el trading no es diferente. Se sabe que en cualquier actividad hay una clara diferencia entre la teorÃa y la práctica. Un porcentaje de personas prefieren y se sienten más útiles y preparadas analizando, estudiando, teorizando, enseñando o adiestrando a otras personas que sacrificando su tiempo frente a una plataforma de trading. Como contrapartida existe una mayorÃa de personas con capacidad, tiempo y gusto para desempeñar la actividad del trading pero con menos deseos de comprender porqués, de analizar motivos y sistemas o de perder su tiempo compartiendo sus conocimientos con otros traders.

Espero haber despejado en la medida de lo posible muchas de las dudas derivadas de la pregunta del tÃtulo.

ð

Rafa.

Vela doji-libélula alcista

Vela doji-libélula alcista

Un martillo alcista

Un martillo alcista Marabozu abierto bajista

Marabozu abierto bajista

Constantemente nos planteamos la duda existencial del porqué muchos prestigiosos gurús y maestros del trading con avalada reputación en el sector de la inversión o especulación financiera «pierden su tiempo» escribiendo libros, artÃculos, blogs, dando charlas o formando a traders cuando podrÃan dedicarse plenamente a la actividad del trading y ganar mucho más dinero.

Constantemente nos planteamos la duda existencial del porqué muchos prestigiosos gurús y maestros del trading con avalada reputación en el sector de la inversión o especulación financiera «pierden su tiempo» escribiendo libros, artÃculos, blogs, dando charlas o formando a traders cuando podrÃan dedicarse plenamente a la actividad del trading y ganar mucho más dinero. También debemos recordar que sobre gustos no hay nada escrito y que hay tantas preferencias y pasiones como personas en el mundo. Muchos disfrutan en gran medida desempeñando otras actividades y consideran excesivamente aburrida y absorbente la monótona práctica de pasar mucho tiempo frente a la plataforma de trading entrando y saliendo de los mercados ellos mismos. Los hay con predilección por escribir libros, apasionados en la concepción y programación de robots o indicadores, los hay que se deleitan realizando análisis técnicos, dando charlas, escribiendo artÃculos en blogs y periódicos, relacionándose con otros traders, estudiando los mercados, calculando stops, respondiendo preguntas, investigando, inventando, creando, descubriendo …

También debemos recordar que sobre gustos no hay nada escrito y que hay tantas preferencias y pasiones como personas en el mundo. Muchos disfrutan en gran medida desempeñando otras actividades y consideran excesivamente aburrida y absorbente la monótona práctica de pasar mucho tiempo frente a la plataforma de trading entrando y saliendo de los mercados ellos mismos. Los hay con predilección por escribir libros, apasionados en la concepción y programación de robots o indicadores, los hay que se deleitan realizando análisis técnicos, dando charlas, escribiendo artÃculos en blogs y periódicos, relacionándose con otros traders, estudiando los mercados, calculando stops, respondiendo preguntas, investigando, inventando, creando, descubriendo … EN CASA DEL HERRERO

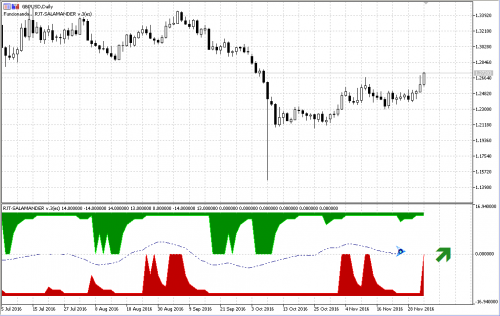

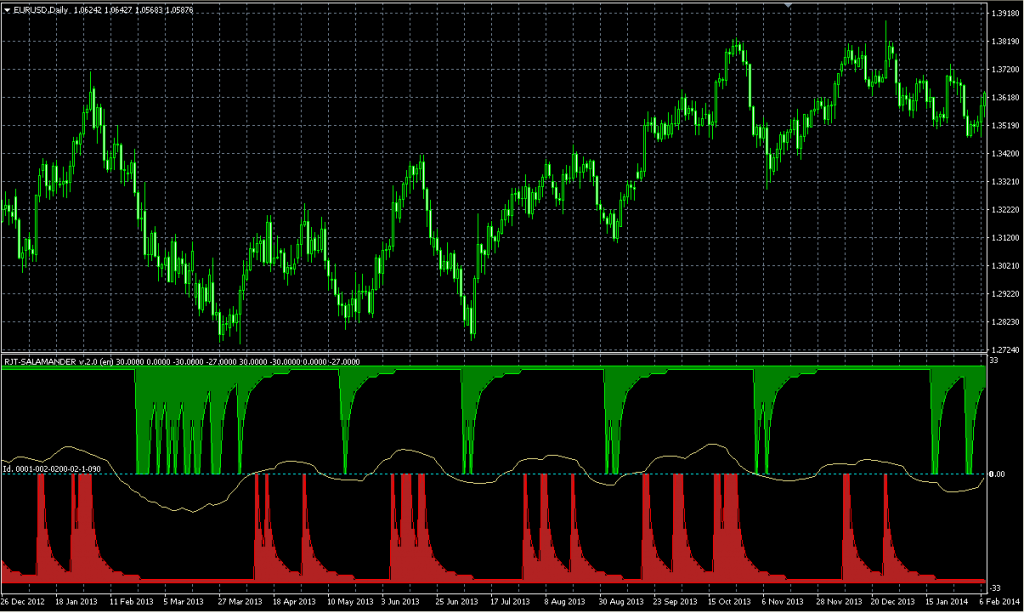

EN CASA DEL HERRERO De todos es sabido que buena parte del éxito en la ejecución de un trabajo se asegura utilizando las herramientas adecuadas.

De todos es sabido que buena parte del éxito en la ejecución de un trabajo se asegura utilizando las herramientas adecuadas.